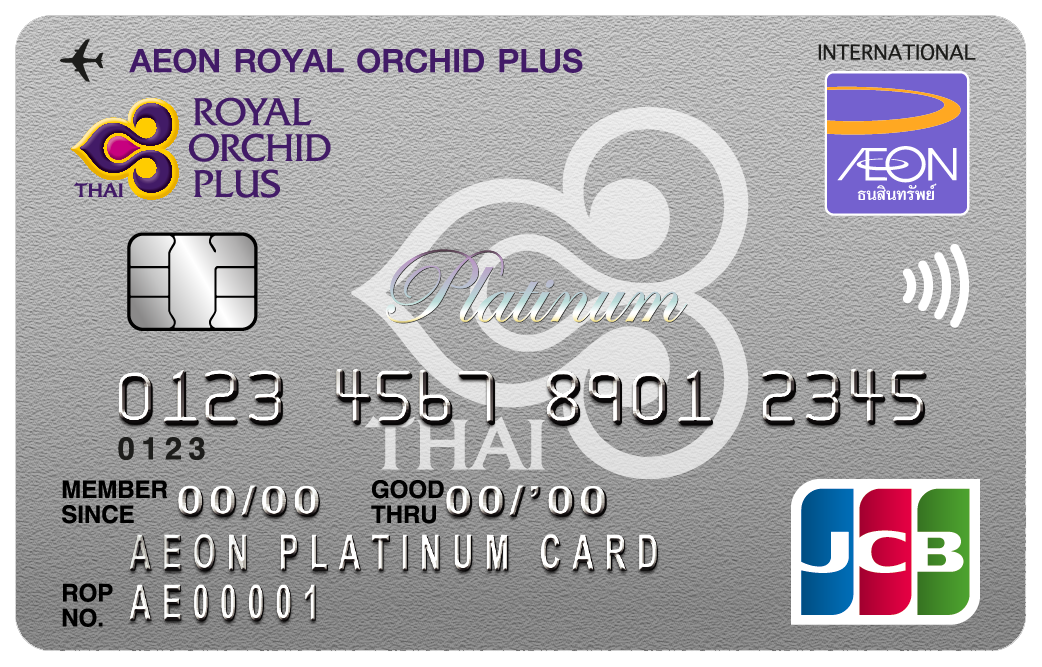

JCB Platinum Privilege

- JCB Plaza

JCB Plaza is an overseas service counter available at JCB Plaza Tokyo. The staff will be available to help AEON J-Premier Platinum Card member with making reservations at JCB merchants and to answer any questions you may have about your travels.

More detail>> www.global.jcb/en/consumers/travel/plaza/ - JCB Plaza Lounge

JCB Plaza Lounges are located in major cities across the globe including Honolulu, Guam, Taipei, Singapore, Paris, Seoul and Hongkong. JCB Plaza Lounge provides drinks, massage chairs and other services you would expect from a lounge for AEON J-Premier Platinum Card.

More detail>> www.global.jcb/en/consumers/travel/plaza/

- JCB Plaza Call Center - Toll Free Service

This service is provided for AEON J-Premier Platinum member to call any time for various information such as travel information, special offer merchant information, reservation service and emergency assistance or help.

More detail>> http://www.global.jcb/en/consumers/travel/plaza-call-center/

- JCB Platinum Airport Lounge Service

Exclusively for AEON J-Premier Platinum Card member to access airport lounges in China, South Korea, Singapore, Germany, Taiwan, United Kingdom, Malaysia, Vietnam, Japan and Hawaii.

More detail>> http://www.global.jcb/en/consumers/platinum/airport-lounge/

- JCB Platinum Concierge Desk

Operators speaking multiple languages are available 24/365 for exclusive Platinum restaurant and golf course reservations, sightseeing, entertainment and support for credit card-related emergencies. Toll free for calls from Thailand at number 1800011321

More detail>> http://www.global.jcb/en/consumers/platinum/concierge-desk/

- JCB Platinum Car Rental Service

This privilege is offered up to 20% discount to AEON J-Premier Platinum Card member for using Rent-a-Car in over 14 countries.

More detail>> www.global.jcb/en/consumers/platinum/car-rental/

JCB Platinum Privilege in Thailand

- Platinum Daily Dining

Get 10% discount when make a payment by AEON J-Premier Platinum Card in participating restaurants. Exclusively promotion for AEON J-Premier Platinum Card member issued in Thailand.

Participating Restaurant:

- Akiyoshi (6 Branches)

- Chabuton (16 Branches)

- Gyu Kaku (6 Branches)

- Katsuya (58 Branches)

- On-Yasai (4 Branches)

- Pepper Lunch (46 Branches)

- See Fah (15 Branches)

- Tenya (12 Branches)

- Yoshinoya (16 Branches)

More detail>> http://www.th.jcb/th/consumers/platinum/daily-dining/

1 January 2023 - 31 December 2023

- Platinum Journey

Exclusive privileges when you travelling to Japan for AEON J-Premier Platinum Card member.

AGODA: Get 15% discount maximum 800 THB / time when make a booking for the eligible hotel in Japan and Get 6% discount when make a booking for the eligible hotel worldwide.

AVIS: Get special price for car rental started from 850 THB/Day when make a reservation in advance.

MSIG: Get 15% discount on participating insurance plans.

KLOOK: Get 12% discount for booking activities with KLOOK with a minimum spending of 3,000 THB / sales slip, maximum discount at 400 THB.

PT Gas station: Get 40 THB discount when make a payment from 1,000 THB / Sales Slip at participated branches. (Register are needed)

More detail>> http://www.th.jcb/th/consumers/platinum/journey/

1 January 2023 - 31 December 2023

- Platinum Lifestyle

This special privilege for AEON J-Premier Platinum Card member.

DOLFIN: Get payment coupon value 50THB when make a payment with Dolfin Wallet from 500 THB/sales slip.

GOLFDIGG: Get 250THB discount when make a payment from 3,000 THB / sales slip.

HOMEPRO ONLINE: Get discount up to 500THB on Thursday when make a full payment from 2,000 THB / sales slip. (Spend 2,000THB get 200THB or 5,000THB get 500THB)

LAZADA: Get 200THB discount on Wednesday when make a payment from 2,000 THB / sales slip.

LINE MAN: Get 50THB LINE MAN discount (excluding delivery fee) when make a payment from 300 THB. (Use Code: JCBLM50)

MAJOR CINEPLEX: Get special movie ticket price 120THB for normal seat in 2D system only. (Extra charge is require for upgrade seat)

TSURUHA: Get 10% discount when make a payment from 500 THB.

TOP SUPERMARKET: Spend 1,500THB get voucher value 100THB.

SHOPEE: Free Delivery

More detail>> http://www.th.jcb/th/consumers/platinum/privileges/

1 January 2023 - 31 December 2023

- Platinum Crown Dining

Get free CROWN DISH (complimentary menu) when make a payment by AEON J-Premier Platinum Card over 1,000 THB at participating restaurants.

More detail>> http://www.th.jcb/th/consumers/platinum/crown-dining/

1 January 2023 - 31 December 2023

AEON Royal Orchid Plus JCB Platinum Promotion

Our newest promotions for AEON J-Premier Platinum Card member including discounts and special offers on merchants and services around the world.

More detail>> www.global.jcb/en/consumers and www.specialoffers.jcb